Boots owners accused of using a legal loophole to avoid paying £1.1BILLION in tax

High street chemist chain comes under fire as trade union bosses say this is just the latest example of Britain being short-changed by big business

http://www.mirror.co.uk/money/city-news/boots-accused-tax-avoidance-scheme-2372134

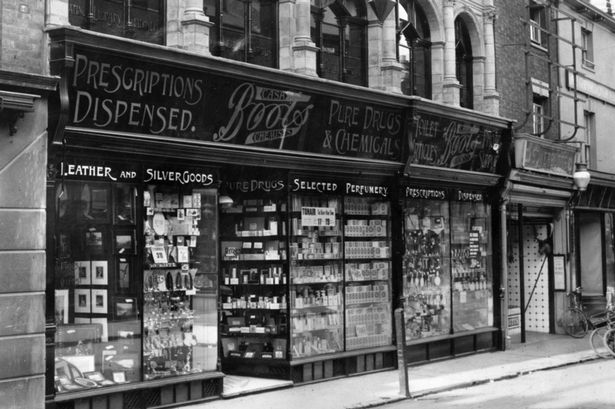

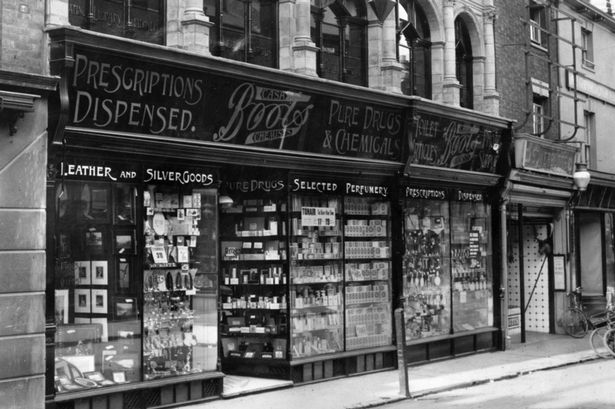

History: Boots began in Nottingham in 1853

The new owners of Boots have been accused of using a legal loophole to avoid paying £1.1BILLION in tax.

Shocked trade union bosses say this is just the latest example of Britain being short-changed by big business.

Unite claim the missing millions from Britain’s high street chemist could have paid for 78,000 nurses, two years of prescription charges or funded 5.2 million emergency ambulance calls.

Boots earns £2.2 billion a year from UK prescription medicines and other services largely funded by the taxpayer through the National Health Service.

Demanding the tax loopholes be closed, Unite General Secretary Len McCluskey thundered: “Tax avoidance is now part of the DNA of a corporate British culture that is rotten to the core.”

Unite and the charity War on Want claim that after private equity bosses borrowed £9billion to buy Boots in 2007 they used interest due on the huge debt to slash UK tax bills by 95%.

Mr McCluskey added: “The revelation that yet another high street name fleeces Britain, taking work from our NHS while avoiding tax responsibilities, will leave taxpayers furious.”

He went on: “While this government pursues the needy with single-minded cruelty, George Osborne does little to stop corporate Britain stripping earnings in the UK and sending profits to tax havens.”

He said the firm had “abused the trust of the British public” and should not be granted public service contracts until it “comes clean on its tax affairs”.

Reuters

But a Boots spokeswoman insisted it “fully complies” with UK law and paid more tax last year than before the 2007 buyout.

She added the firm had spent £1billion to grow business in the UK and had paid £1billion into pension pots.

Boots, founded in Nottingham in 1853, was purchased six years ago by Italian billionaire Stefano Pessina and US private equity firm Kohlberg Kravis Roberts.

It moved its HQ from Nottingham to low-tax Switzerland and is now owned via a firm based in Gibraltar.

Over the following six years, despite making operating profits of more than £5billion, the accounts of Alliance Boots show the firm has ended up with an overall tax credit worth £130million.

The firm insisted it paid the same amount of tax in the UK as it would had it stayed based here.

But Unite and War on Want claim that, without its debts, Boots would have made another £4.2billion profits in the UK which would have meant a further £1.1billion collected in corporation tax.

John Hilary, executive director of War on Want, added his voice to Unite’s call. “Ministers have allowed corporations such as Boots and its private equity owners to abuse the UK’s tax system. It is time to make companies like Boots pay their fair share,” he said.

Researcher Nell Geiser, from Change to Win, added: “After avoiding millions in UK tax through massive borrowing, Alliance Boots’ private owners are selling out and stand to profit handsomely.

“Corporate tax avoidance is not going away unless we shine a light on it and unless policy-makers act decisively.”

A string of multi-nationals have been accused of using legals ploys to avoid UK taxes in recent years, including Starbucks, Vodafone, Google, Facebook and Apple.

HM Revenue and Customs estimates it misses out on £35billion of tax every year, including £8.8billion from big business.

Some experts believe £100billion of tax is legally avoided and illegally evaded.

Last week, the Mirror and Corporate Watch revealed that payday lender Wonga has part-moved to Switzerland.